Please select your question category

| | ||||||||||||||||||||||||||||

|

Values are based on aircraft market value guides adjusted for various circumstances such as time on the engine, etc. The Aircraft Property Statement that you submit provides us with the information necessary to determine any adjustment. Indicate on the Aircraft Property Statement that the aircraft was sold and provide the name and address of the buyer, the selling price and attach a copy of the bill of sale. Sign the form and return to the Assessor's Office. In order to properly determine the value of your aircraft we must have the information that you are asked to provide on the statement. Without the information, your aircraft will be valued in average condition at mid-time and a 10% penalty will be added for failure to file the statement. An aircraft is assessed in the county where it is habitually situated.

Yes, indicate on the statement the status (closed, sold or moved) of your business including the date the status change took place. Please, with our one page e-filing invitation letter, navigate to our e-filing web site, and use the account number and BIN to download your statement. Go to miscellaneous forms and print out the form titled “Moved, Closed, Sold - Supplemental Form” so you can fill out the supplemental form and send it with your signed property statement. On the supplemental form please remember to fill out the fields that let us know the date you went out of business, as well as the status and disposition of any equipment owned or used by you at the time the business closed.

No. We do not have access to all the information. | ||||||||||||||||||||||||||||

|

Annual Notifications of Assessed Value are mailed to all property owners at the end of June each year. If you did not receive your Notification of Assessed Value after the second week of July each year, you can request a duplicate notice be mailed to you by requesting online, contacting the Santa Clara County Assessor’s Office at [email protected] or 408-299-5500. | ||||||||||||||||||||||||||||

|

A valuation card/letter is mailed to you each May for the regular annual assessment. This card/letter contains important information about your property, including the value as of January 1, referred to as the "lien date". Separate notices are mailed for special assessments, referred to as "supplemental", or "escape", assessments. You may also look up your assessed value on our website. The County Assessor, who is elected by the people, is directed by the California Constitution to assess all taxable property within the County. By law, the assessment of property involves estimating a property's value and listing that value on the assessment roll. In preparing the assessment roll, the Assessor Department estimates a property's full cash value. Appraising is not an exact science, but is an opinion based on consideration of relevant facts. Most appeals heard by an Assessment Appeals Board are scheduled within one year. Revenue and Taxation Code § 1604, however, allows up to two years for an assessment appeal to be decided. No, there is no charge to file an assessment appeal. Applications for regular appeals must be filed with the Clerk of the Assessment Appeals Board between July 2 and not later than September 15 each year. Applications for "SUPPLEMENTAL" or "ESCAPE" assessments must be filed no later than sixty (60) days after the Notice of Assessment. Roll Change/Escape Asssessment filing dates are within 60 days after the mailing of the roll change assessment notice or escape tax bill. An Assessment appeal is your opportunity to challenge the assessed value placed upon your property by the Assessor. Differences of opinion can and do arise. Property owners have a right to challenge their property assessments by filing an Assessment Appeal with the Assessment Appeals Board. You are also urged to contact the Assessor to verify the circumstances of the assessment. This will assist you in understanding the method used in appraising your property. You may also ask the Assessor for an informal, review which may result in an adjustment without requiring further action. Be sure to check with the Assessor for any form or filing deadline that may apply to an informal review. Contact the Clerk of the Assessment Appeals Board at (408) 299-5088. Any property owner who disagrees with the assessed value of his/her property may file an appeal. Although not required, a property owner may have an attorney, family member or professional tax agent file on his/her behalf. The assessed value of property and the tax rate applied to this value equals the amount of tax money each property owner is required to pay. The Assessment Appeals process concerns only the assessed value of your property. Determinations of value are made by either a three member Assessment Appeals Board or a Hearing Officer. These individuals are appointed by the Board of Supervisors to serve as the local board of equalization. They must have experience as an appraiser, real estate broker, CPA or attorney. Their role is to determine the value of your property based upon evidence presented by you and the Assessor. Possibly. If you disagree with the assessed value of your property, can support it with evidence, and are not satisfied with the outcome of an informal review with the Assessor, you may wish to file an application. ALL QUESTIONS ON THE APPLICATION MUST BE ANSWERED.

Mail the completed and signed application to the Post Office Box listed on the application. Yes. Don't forget to pay your property tax bill to the Tax Collector while awaiting the outcome of your appeal. The assessment of your property is deemed correct until such time as it is changed by the Board. If taxes are not paid in a timely manner, you will be subject to a non-refundable 10% penalty regardless of whether your assessment is subsequently adjusted. If adjusted, your refund will include the amount of overpayment plus interest. At the hearing, you and the Assessor are given the opportunity to present factual evidence to substantiate your opinions of value. All testimony is presented under oath. You and the Assessor may question each other regarding the evidence presented.

The Board or Hearing Officer will either advise you of their decision at the conclusion of the hearing or you will be notified of their decision by mail at a later date. This decision is final | ||||||||||||||||||||||||||||

|

The California Constitution and the Revenue and Taxation Code state that all property is taxable (including boats and other vessels such as jet skis) unless it is specifically exempt by law. In California all property, including boats/vessels, is taxable unless specifically exempt by law. (R&T 201) A jet ski is considered a boat and is not exempt, therefore it is taxable. Yes. Unsecured property taxes are not prorated by the Tax Collector's Office. Any activity occurring after the lien date are the responsibility of the seller and new owner. Yes. This information will help prevent you from receiving a tax bill on property you no longer own during the next Roll year. In addition, you should fill out a Release of Liability form with the Department of Motor Vehicles (DMV). California registration indicates the boat is kept in California. Boats are assessed in the county were habitually situated

The DMV collects only a registration fee, currently $5, for the boat. The county Assessor administers property taxes, including personal property. Boat values, upon which the personal property taxes are based, are included in personal property

| ||||||||||||||||||||||||||||

|

The exclusion only applies to the initial Supplemental Assessment and does not preclude the reassessment of any such property on the assessment roll as of the first of January following the date of completion of construction or to any other Supplemental Assessments on the property. Anyone who builds on property which he/she owns is eligible. There is no other requirement.

There is no filing fee nor are there any other costs involved with the Builder's Exclusion.

There are only two simple requirements for the Builder's Exclusion:

A failure by the property owner to notify the Assessor of such a change within 45 days may result in a penalty of $100 or 10% of the taxes applicable to the new base year value of the property, whichever is greater, but not to exceed $2,500.

According to the California Revenue and Taxation Code: The owner shall notify the Assessor prior to, or within 30 days of, the date of commencement of construction that he or she does not intend to occupy or use the property. If the owner does not notify the Assessor as provided in this subdivision, the date (for purposes of calculating the supplemental assessment) shall be conclusively presumed to be the date of completion.

| ||||||||||||||||||||||||||||

|

In general, there are five (5) types of property statements: Business Property Statement, Agricultural Property Statement, Apartment Property Statement; Vessel Owner's Property Statement and Aircraft Owner's Statement. This form is used to assist the Assessor in determining value of taxable property for assessment purposes. December 31st of each year. The Assessor's records indicate that you were doing business at this location the lien date, January 1. The lien date is the day that the taxes become a lien on the property and/or its owners, even though the valuation and tax bills have not yet been computed and mailed. The tax lien date is January 1 of each year (Revenue and Taxation Code, Section 2192). All machinery, equipment, fixtures, construction in progress and leasehold improvements held or used in connection with a trade or business are taxable as business property. The property statement is used to assist the Assessor in determining the value of taxable business property for assessment purposes.

Per Revenue and Taxation Code, Section 441 you must file a statement if . . . The Assessor's office has sent you a property statement OR You have taxable personal property with a total cost of $100,000 or more located within Santa Clara County as of January 1 of each year even if no property statement is sent to you. Failure to complete and return the property statement will result in the Assessor estimating the value of your business property and adding a 10% penalty to the assessment. (Revenue and Taxation Code, Sections 441, 463 and 501). | ||||||||||||||||||||||||||||

|

There are three exemptions which may be claimed on church property:

The content of a religious belief is not a matter of governmental concern and should not be subject to an inquiry concerning its validity. The county assessor, however, is required to administer the exemption. The courts have defined "religion" by enumerating the elements of a religion to simply include:

"Worship" has been defined by the courts as the formal observance of the religious tenets or belief. Contrary to a common belief, not all activities engaged in by religious organizations qualify for property tax exemption. Some non-qualifying uses are:

| ||||||||||||||||||||||||||||

|

Any item that you are consuming in your business, such as office supplies, pencils, paper, calculator tape, stationary, envelopes, cleaning supplies, fuel and etc. is a supply item. If you are a manufacturer, 'supplies' would not include anything that becomes part of the finished product. Materials or supplies that are integrated into the products you market are exempt because they become business inventory once in the products, and business inventory is exempt from property taxation. Generally, inventory consists of items that are available for sale, rent or lease on the lien date, January 1. Equipment out on rent or lease on the lien date is not available for sale, rent or lease and therefore is assessable. Supplies are items self consumed in the normal course of business.

All original costs associated with bringing personal property to a functioning status must be reported. These costs include but are not necessarily limited to sales tax, freight and installation. Down payments and trade-ins should not be deducted from original costs.

No. You must report personal property holdings in detail and as requested or mandated. If nothing has changed from the prior year (no equipment was purchased or sold), then you may refer to your prior year's statement filing in order to be consistent in completing the current statement. If you failed to keep a copy of the prior year's filing, you may request a copy of it from the Assessor's Office. A note to those who e-filed in prior years, as a new service you can download your prior years statements after you log in at the Assessor’s e-filing web site.

Yes. Note that circumstance in a remark on the statement, or an attachment, and also include the proper location and mailing address of your main office. Then sign and return the statement to the Assessor's Office.

Yes. The law specifies that all taxable personal property must be assessed as of a specific point in time, and that point is precisely at 12:01 A.M. January 1 (regardless of what transpires after that date). Even if closed shortly after the lien date (January l), a business must still file a statement and pay taxes for the coming fiscal year (July l through June 30) on any taxable property they owned on the lien date.

Yes. A business does not have to be open for its taxable personal property to be subject to assessment. For example, let's presume that on the lien date, January 1, a new pizza parlor is under construction and nearly ready for its grand opening. Even though the pizza parlor was not open for business on the lien date, taxable business personal property (such as furniture, ovens and supplies) was in the owner's possession on the lien date and the Assessor is required to assess it.

Yes. The fastest way to inform the Assessor’s Office that your business has moved or was closed is to print and sign the “Moved, Closed, Sold - Supplemental Form.” This one page form should be mailed and enclosed with your signed property statement. Anytime a person receives a statement from the Assessor and their business is no longer in operation, the statement must still be signed and returned to the Assessor. You should also include a note on the statement indicating that the business has closed. If this is not done, the Assessor will not be aware of that fact, and may continue to assess the property despite its true circumstance. To quickly download your property statement and this simple form please follow the instructions on the one page e-filing invitation letter navigate to the Assessor’s e-filing web site (http://efile.sccassessor.org), and use the account number and BIN to download your statement. To print out the form titled “Moved, Closed, Sold - Supplemental Form” follow the on-line instructions or go to miscellaneous forms. Do no forget to sign and mail both this form and your property statement. On the supplemental form please remember to fill out the fields that informs us the date you went out of business, as well as the status and disposition of any equipment owned or used by you at the time the business closed. If any of the property was sold to another person or business, please indicate the buyer's name and address. If any of the property reverted to your own personal use as household personal property, you need to identify that property as well. Please then sign and return the statement to the Assessor's Office. Note: Where a business has closed but you still own equipment previously used in the business, it may still be taxable despite the fact the business is closed. A separate Moved, Closed, Sold - Supplemental Form and property statement must be mailed for each location that closed or moved. | ||||||||||||||||||||||||||||

|

This is a property tax exemption on the principal residence of a qualified disabled veteran. The veteran must be totally disabled as a result of a service-connected injury or disease. The rating must be issued by the US Veterans Administration as 100% totally disabled or has rated the disability compensation at 100% by reason of being unable to secure or follow a substantially gainful occupation

A Disabled Veteran claim form must be submitted to the Assessor's Office along with a letter from the Veterans Administration that states the rating (100%) of the service connected disability along with proof of honorable discharge.

In most cases, the filing deadline is 5:00 p.m. on February 15 or within 30 days from the date of the Notice of Supplemental Assessment. Once granted, the exemption remains in effect until you either move from the property, are no longer on title to the property, or until your disability rating changes.. It is the responsibility of the claimant to notify the Assessor's Office of any of these changes. A yearly termination notice is sent in January as a reminder to claimants to contact the office if changes have occurred from the prior year.

Yes. The surviving spouse can qualify if their spouse was previously eligible or if they are the surviving spouse of a veteran who died while on active duty. A new claim must be completed and submitted with a copy of their marriage certificate and a copy of the veteran's death certificate.

No. The Assessor's Office should be contacted immediately.

No. Only one exemption is allowed.

No. This exemption is available to any qualified disabled veteran who resides here regardless of where they originally enlisted in the service.

To receive a claim form, please contact the Exemption Division at (408) 299-6460. | ||||||||||||||||||||||||||||

|

I want to transfer a 40% interest in my home to my domestic partner. Will my property be reassessed?

No, your property will not be reassessed as long as you and your partner are registered domestic partners at the time the transfer occurs.

Effective January 1, 2008, and upon application, transfers of real property and mobile homes between registered domestic partners in the State of California during the period January 1, 2000, and December 31, 2005, are excluded from the meaning of “change in ownership” that in other circumstances results in reassessment for property tax purposes. Relief will be provided on a prospective basis. The deadline to apply for this specific exclusion is June 30, 2009

No. As long as you are registered domestic partners on his date of death, you will not be reassessed.

No. If the transfer is pursuant to a property settlement agreement, decree of dissolution or legal separation between you and your former registered domestic partner, the home will not be reassessed. However, if either of you subsequently transfer your 50% interest to each other or a third party, a 50% reappraisable change in ownership will result.

Yes. The domestic partnership exclusion for property tax purposes applies to all qualified domestic partners registered with the State of California.

It depends. There may be an exclusion under Rule 462.040. This rule involves joint tenancy. It is advisable that you and your domestic partner speak with an attorney, and a CPA who understand the complexities involving estate planning and taxation regarding domestic partnerships Because you and your partner will be purchasing your home from a third party, there will be a change-in-ownership, and therefore a reassessment of the property. There is no exclusion from reassessment for this type of transfers involving third parties as sellers/transferors and you and your partner as buyers/transferees. If you then decide to transfer an interest in the home between you and your partner, there will not be a reassessment since you are both registered domestic partners. Before taking title to the property, it’s advisable that you contact an attorney regarding how to hold title.

It’s best to consult with an attorney and tax advisor regarding how to hold title regarding any of the above situations. For assessment purposes, you may want to consider the following: a) When property is acquired, the manner in which title is vested does not affect the determination of whether it will be reappraised for assessment purposes. Nearly all purchases or other acquisitions of real property will result in a reappraisal, although there are exclusions available in some circumstances such as transfer from parents to children, etc. b) When property is conveyed between spouses and/or registered domestic partners pursuant to a divorce or disillusionment, the reappraisal status is determined by the legal document affecting the disillusionment. Generally speaking, if the property is conveyed to the ex-spouse or ex-partner pursuant to the disillusionment, the document transfer will not be subject to reappraisal—it will be treated the same as a transfer between spouses or registered domestic partners. If the property, or a partial interest in the property, is conveyed to a third party, that portion will be subject to reappraisal. c) Similar to response b) above, if the property is conveyed or inherited by a spouse or registered domestic partner at the time of death it will not be reappraised. However, if the property, or a partial interest in the property, is conveyed to a third party, that portion will be subject to reappraisal | ||||||||||||||||||||||||||||

|

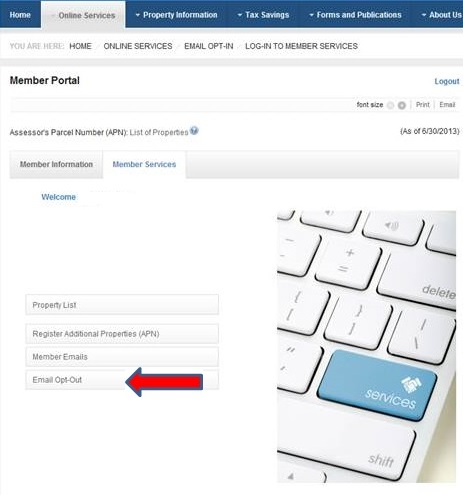

You must first log in to the E-mail Opt-In Login page. Once logged in, the E-mail Opt-Out feature appears on the Member Services tab.

| ||||||||||||||||||||||||||||

|

Occasionally the Assessor must make a correction to an assessed value after an assessment roll (a list of all property in the county together with their assessed values) has been completed and turned over to the Auditor-Controller and then to the Tax Collector for billing. These corrections or changes to an assessed value are known as “escaped assessments”. These corrections could be the result of an error by the Assessor’s office or by the property owner. An example would be the Assessor’s office not assessing new construction in a timely manner or the property owner building an addition without obtaining a building permit, therefore, the Assessor’s office was not aware of the new construction. Since escape assessments always deal with value that should have been assessed but wasn’t, additional taxes will be due. However, the current owner will not be responsible for taxes on any escape assessment that covers a time period before they acquired the property. R&T Code Section 531. | ||||||||||||||||||||||||||||

|

The California State Constitution requires the county assessor, Lawrence E. Stone, to identify, value and assess all property in Santa Clara County for property tax purposes.

The California Constitution states in part that, 'Unless otherwise provided by this Constitution or the laws of the United States, (a) All property is taxable....' That is, unless otherwise exempted, all forms of tangible property are taxable in California and the Assessor must assess business personal property because the law requires he or she do so. Some forms of personal property are exempt from taxation under the Constitution. For example, household furnishings, personal effects and business inventory are exempt under the law. However, Business Personal Property is not exempt under the law and neither are privately or business-owned boats or aircraft. All machinery, equipment, tools, furniture, fixtures, and leasehold improvements held or used by you in connection with a trade or business; boats; aircraft; and mobile homes. Supplies on hand, demonstration equipment, and construction-in-progress are also assessable. All costs before trade-in including sales tax, freight and installation must be reported on the property statement whether capitalized, expensed or fully depreciated. Inventory held for sale, rent or lease, application software and licensed vehicles are not taxable.

For most property, the Assessor begins with the reported cost of taxable property and applies price indexes and depreciation factors in calculating the assessable market value for personal property. All assessments are subject to audit.

| ||||||||||||||||||||||||||||

|

The Homeowner's Exemption is essentially a property tax break for homeowners who own and occupy their primary residence (dwelling) on January 1. Homeowners are eligible to receive a reduction of up to $7,000 off of the property's assessed value (resulting in approximately a $70 to $80 annual savings per year).

The Homeowners' Exemption Claim Form asks what date I OCCUPIED the property. What date should I use?

Use the date you first moved into the property but only if your occupancy of the property has been continuous since that date. If you previously vacated the property and then moved back, use the most recent date you moved-in. (Approximate dates are acceptable)

No. Unfortunately, we process tens of thousands of claims every year and have neither the staff nor resources to provide such notice. However, you will be contacted if more information is needed, or if your claim is denied. As always, you are welcome to contact our office and our staff can verify your exemption status.

Yes. You must notify the Assessor in writing whenever a property you own is no longer eligible for the Homeowner's Exemption. Please notify us as soon as possible after vacating the property, but in no case later than the first December 10 following the lien date (January 1) immediately following your vacating the property. Failure to notify the Assessor will result in escape assessments and penalties if an unauthorized exemption is discovered.

Whenever there is a transfer of ownership of residential property, the Assessor's Office will automatically mail a homeowner's exemption claim form to the new owner(s). You may also call the Exemption Division at (408) 299-6460 to request a claim form.

This is a free service provided by the Assessor's Office. There is no charge

Your exemption will be shown on your tax bill. Look in the lower left corner of your bill under the category "homeowner exemption". To the right of that description, your exemption amount should appear. Yes. The regular filing deadline is February 15th to receive the full exemption. A late exemption ($5,600) can be claimed if the claim is received by December 10th

A dwelling is defined as:

No, the law provides that once you qualify for the Homeowner's Exemption it is not necessary to file each year. Your exemption will be applied for each successive tax year as long as you continue to own and occupy your primary residence.

The Social Security numbers are used by the Assessor to verify the eligibility of persons claiming the Homeowners' Exemption. These numbers are also used by the State to prevent multiple claims in different counties and to verify the eligibility of persons claiming income tax renters' credit.

Yes, as long as you notify the Assessor of any change in your primary residence. You must first terminate your exemption on your current dwelling. A new claim must be completed for your new primary residence. The new exemption will be in effect only if the primary residence was occupied on January 1. State law provides a guardian, executor or other legal representative may sign on behalf of an incompetent or deceased owner by inserting his/her name and capacity on the signature line and the date of death if the owner is deceased

To obtain the exemption for a property, you must be its owner or co-owner (or a purchaser named in a contract of sale), and you must live in the property as your principal place of residence. You must also file the appropriate exemption claim form with the Assessor. Upon receiving notification that the property has been transferred, the homeowner exemption claim form is automatically mailed to you.

No. You are only entitled to one Homeowner's Exemption.

Yes. A new Homeowner's Exemption claim is required any time there has been any change in the manner in which title is held. Whenever the Assessor becomes aware of a change in the way title is held in a property, the existing exemption is canceled and a new Homeowner's Exemption claim form is sent to the owner of record. A new exemption claim must then be filed to renew the exemption even though occupancy may not have changed. If you receive a new claim form in the mail, do not ignore it; you might lose your existing exemption if you do not respond Yes. In order for your property to receive the exemption in the years following your acquisition, you, as the new owner, must file a claim even if the property was already receiving the Homeowners' Exemption under the prior owner.

Unfortunately, the answer is no. In order to be eligible, they must both own and occupy the property as specified in the law. Owners who permanently relocate to a rest home must also notify the Assessor that they are no longer eligible for the exemption. Failure to do so will result in escape assessments and penalties if an unauthorized exemption is discovered.

A temporary move to a convalescent hospital will not disqualify the property from the exemption unless the stay becomes prolonged. In other words, the exemption is allowed if the owner is expected to return. However, according to the State Board of Equalization, an absence of more than one year raises considerable doubt that the owner is expected to return, and in that case eligibility may be terminated

Where the Disabled Veterans Exemption is concerned, the answer is no, you are only entitled to have one or the other exemption, but not both. The Disabled Veterans' Exemption ($150,000 maximum) normally provides much more benefit than the Homeowner's Exemption ($7,000 maximum), and is the preferred choice if one must chose between the two. Where the Veterans' Exemption is concerned, the answer is generally, no. This exemption has a $4,000 maximum benefit and very restrictive income limits. However, there are some very rare instances where an owner may legally hold the Veterans' Exemption and a Homeowner's Exemption simultaneously, and you should discuss this issue with the Assessor's staff if you think it might apply to you. The Homeowner's Exemption ($7,000 maximum) provides more benefit than the Veterans' Exemption ($4,000 maximum), and is the preferred choice if one must chose between the two

The Homeowners' Exemption Claim Form asks what date I ACQUIRED the property. What date should I use?

Use the original date you first became the owner of the property (approximate dates are acceptable)

No. The Homeowner's Exemption claim form is NOT a public document and both it and the Social Security number information on the form must be held confidential by the Assessor as a matter of law (ref Property Tax Rule 135(e)(4)).

| ||||||||||||||||||||||||||||

|

The due date is April 1st of each year. If Date falls on Saturday, Sunday or Legal Holiday, mail postmarked on the next business day shall be deemed on time

The final day to file is May 7, or the next business day if May 7 falls on Saturday or Sunday. If the statement is not filed or is filed after May 7 a 10% penalty may be applicable. (Revenue and Taxation Code, Section 463).

Av 10% failure to file penalty will be added to the assessment.

No, if the envelope is postmarked by the US Post Office on or before the delinquency date, the penalty is not applicable. However, postage meter cancellation is not considered "postmarked by the US Post Office" and the penalty would be applicable. The Assessor's Office is responsible for making reasonable assessments based on available information. If you do not file a property statement, the Assessor will estimate the assessable value. In addition, a 10% penalty for failure to file will be added to your assessment. (Revenue and Taxation Code, Sections 441, 463, 501)

An amended property statement for the current year only may be filed no later than May 31 of the current year. Any decreases in value after May 31 may be allowable only as the result of an audit.

The statement must be signed by the assessee, partner, a duly appointed fiduciary, or an agent. When signed by an agent or employee other than a member of the bar, a certified public accountant, a public account, enrolled agent or a duly appointed fiduciary, the assessee's written authorization of the agent or employee to sign must be filed with the Assessor. The signature on the authorization must be an original, not a fax or copy. In the case of a corporate asessee, the statement must be signed by an officer or by an employee or agent whom the board of directors has designated in writing. A property statement that is not signed in accordance with the foregoing instructions does not constitute a valid filing and may be subject to the 10% failure to file penalty.

Yes, indicate on the statement the status (closed, sold or moved) of your business including the date the status change took place. Please, with our one page e-filing invitation letter, navigate to our e-filing web site, and use the account number and BIN to download your statement. Go to miscellaneous forms and print out the form titled “Moved, Closed, Sold - Supplemental Form” so you can fill out the supplemental form and send it with your signed property statement. On the supplemental form please remember to fill out the fields that let us know the date you went out of business, as well as the status and disposition of any equipment owned or used by you at the time the business closed.

No. Any arrangement regarding property tax liability is the responsibility of the buyer and seller.

Yes. There is no prohibition or restriction on allocation of the base year values. You are allowed to transfer the base year value of a property taken that consists of land and improvements to a replacement property consisting of only improvements or only land. Yes, the filing laws apply to non-profit organizations also. Non-profit organizations may, however, qualify for exemptions. They should contact the Exemption Division of the Assessor's Office at (408) 299-6460 | ||||||||||||||||||||||||||||

|

We recommend that you contact a Licensed Land Surveyor or Engineer to locate your property lines on the ground. We normally use what is shown on the latest recorded legal description of your property, or what occurred through various types of requests. You can contact the Public Service Counter of the Assessor's Office to get the document number containing the latest recorded legal description. PLEASE NOTE THAT ALL DATA CONTAINED ON OUR ASSESSOR'S MAPS ARE FOR ASSESSMENT PURPOSES ONLY Postal delivery zones are set by the U. S. Post Office without regard to where the city limits are located or whether homes are outside of city limits. For example: there are large areas of San Jose that have a Campbell mailing address with zip code 95008.

In the Assessor's Office, we use the acreage shown on recorded subdivision maps. We usually do not show acreage under one (1) acre on our maps, unless it is stated on a particular document. However there are instances when it has been necessary to do so and that is why sometimes you will find such acreage on some of our maps. If you want to get an accurate measure of your property's acreage we recommend that you contact a Licensed Land Surveyor or Engineer. Please note that all data contained on our assessor's maps are for assessment purposes only.

Your APN (Assessor's Parcel Number) can change for a variety of reasons, which include, but are not limited to:

Your parcel could change as a result. Your property taxes would not be effected in such a case. If you have further inquiries on this topic do not hesitate to call our on duty staff at (408)299-5550. s, which include, but are not limited to:

Your parcel could change as a result. Your property taxes would not be effected in such a case Assessor's Parcel Numbers are assigned based on various events. They include, but are not limited to:

Each of these events is effective for a particular assessment roll of a given fiscal year based on an effective date in the previous calendar year. For example, if a deed splitting a parcel is recorded in the County Recorder's Office in March of 1998, the new Assessor's Parcel Numbers for the related properties will be issued July 1, 1999, effective for the assessment roll in fiscal year 1999-2000. The Assessor's Office assigns parcel numbers for assessment purposes only, based upon deeds and maps recorded with the County Recorder's Office. The lot line adjustment approval is authority for you to record the document. If a portion of the property changes ownership in the transaction, it will be subject to reappraisal.

Your escrow account should state that there has been some amount put toward the taxes for the original parcel. You will receive a supplemental property tax bill, which should arrive about six to ten months after purchase. If you have further questions talk to your homeowner's association or contact Tax Information at (408) 808-7900. | ||||||||||||||||||||||||||||

|

A mobile home is a structure, transportable in one or more sections, designed and equipped to contain one or more dwelling units, and to be used with or without a foundation system. Specifically any trailer coach that is more than eight feet wide or forty feet long, or one that requires a permit to move on the highway is considered a mobile home

No. Recreational vehicles, as well as buses and prefabricated housing units, are not considered mobile homes.

For purposes of taxation, mobile homes affixed to the land on a permanent foundation are not considered "mobile" homes, but are viewed instead as modular housing, and have always been taxed in the same way as conventional homes. If your mobile home is not attached to a permanent foundation, for example, if your mobile home is in a mobile home park please read on. Throughout the remainder of this FAQ, the term "mobile home" refers only to those that are not on permanent foundations. If your mobile home was originally purchased new on or after July 1, 1980, it was automatically subject to local property taxes. Also if the license fees on your mobilehome, regardless of when it was originally purchased became delinquent on or before May 31, 1984, your mobile home was automatically converted to the local property tax system. (Delinquent license fees no longer cause automatic transfer to local property taxation.) There may be advantages, but each case must be evaluated individually. One possible advantage is that property taxes are payable in two annual installments. You also may be entitled to the $7,000 homeowner's exemption or other exemptions administered by the County Assessor. In addition to County exemptions, you may be eligible for the tax assistance and postponement program offered by the State of California. NOTE: This program has been temporarily suspended by the State of California. For more information go to http://www.sco.ca.gov/col/taxinfo/ptp/index.shtml Finally, it is important to note that mobile homes subject to local property taxation are exempt from any sales or use tax. Therefore, you may enhance the marketability of your mobile home by voluntarily converting it to local property taxation prior to selling it. Once you convert to local property taxation, however, you cannot revert back to vehicle license fees Information regarding homeowner's and other exemptions can be obtained by e-mailing, calling or mailing the office of the County Assessor.

The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are 62 or older, blind, or disabled. For information on the State's Homeowner or Renter Assistance Program, call the Franchise Tax Board at (800) 852-5711. For information on the Property Tax Postponement Program, call the State Controller at (800) 952-5661. NOTE: This program has been temporarily suspended by the State of California. More Information is available at http://www.sco.ca.gov/ardtax_prop_tax_postponement.html You can request a voluntary conversion to local property taxes by calling (800) 952-8356 or writing to: State of California, Department of Housing and Community Development (HCD), P.O. Box 2111, 6007 Folsom Blvd., Sacramento, CA 95810.

No. Once mobile homes have been changed to local property taxation, it is not possible to reinstate vehicle in-lieu license fees.

Mobile home title issuance is administered by the State's Department of Housing and Community Development (HCD). That department cannot transfer title of a used mobilehome subject to local property taxes without a tax clearance from the county tax collector of the county in which the mobile home is situated. If there are any taxes owing, they must be paid before a Tax Clearance Certificate can be issued.

It depends on what type of taxes you currently are paying. Mobile homes that are subject to local property taxation are subject to supplemental taxes. Mobile homes that are subject to vehicle license fees are not subject to supplemental taxes thru HCD, however may be subject to supplemental and annual taxes for the addition. Contact the County Assessor for additional information.

The amount of property taxes on your mobile home is determined in accordance with the State Law and is limited to $1 per $100 (1%) of assessed value of your mobile home, except for certain direct assessments applied by cities and districts and special taxes approved by local voters. The County Assessor determines the assessed value of your mobile home, which is generally the cash or market value at the time of purchase. This value increases not more than 2% per year until the mobile home is sold, at which time it must be reassessed. If your mobile home is parked on land that you own, the land will be assessed and taxed separately. Yes. You may take the matter up with the Assessor to see if that office will change the valuation. Additionally, the Board of Supervisors has established an Assessment Appeals Board for the purpose of resolving valuation problems. Additional information regarding appeals can be obtained by calling (408) 299-4321

If you do not pay the first installment of your annual tax bill at the Tax Collector's office by 5 pm on December 10, or payment is not postmarked by that time and date, then that installment becomes delinquent, and a 10% delinquent penalty on the unpaid taxes is incurred. If you fail to pay the second installment at the Tax Collector's office by 5 pm on April 10, or payment is not postmarked by that time and date, it also becomes delinquent and incurs the 10% penalty plus an additional processing charge. Likewise, if you fail to pay any supplemental tax bill installment by the applicable delinquency date, the same penalties accrue as for delinquent annual taxes. There is no provision for an installment plan of redemption for delinquent mobile home property taxes. As soon as an installment becomes delinquent, the County has the right to take any of the following steps to collect the unpaid taxes and penalties on a mobile home:

Supplemental tax bill installment by the applicable delinquency date, the same penalties accrue as for delinquent annual taxes. There is no provision for an installment plan of redemption for delinquent mobile home property taxes. As soon as an installment becomes delinquent, the County has the right to take any of the following steps to collect the unpaid taxes and penalties on a mobile home:

You can qualify for either a homeowner's exemption or a renter's credit on your State Income Tax Return. You cannot, however, claim both. To determine which is more advantageous to you, contact the Exemption Division at (408) 299-6460.

| ||||||||||||||||||||||||||||

|

Yes, by law the Business Property Statements are confidential documents and are held in secret by the Assessor.

The State Constitution says ALL property is subject to property tax. Most people are familiar with the property taxes on their home. Similarly the assets of business are subject to assessment.

Business property is any tangible property owned, claimed, used, possessed or controlled in the conduct of a trade or business. In general, business personal property is ALL property owned or leased by a business except real property and inventory. Inventory is property held for sale or lease to others in the course of your business operations.

All machinery, office furniture and equipment, non licensed vehicles, process or trade fixtures, and any inventory that is out on rent or lease on January 1. Stand alone computer programs like Excel and D-Base, business inventories, licensed vehicles and any intangible assets are exempt from assessment.

Assessment begins with the cost of the asset, including sales tax, freight and installation, but not including any trade in. This cost basis is generally the same as your tax basis. The assessor applies a depreciation factor to the assets cost and this becomes the assessed value. The depreciation schedule is different from the tax depreciation schedule your tax accountant uses. Our depreciation schedule is based on expected economic life.

The tax rate is usually a little more than 1% of the assessed value. Generally, using a rate of 1.2% will give a conservative estimate. For example, if your business assets cost basis is $15,000, and the depreciated assessed value is $12,000, your property taxes on your business assets will be about $145.

If you do not own the real property where the business is conducted, and if the business property statement was filed timely, you should receive your bill by the end of July. Payment will become delinquent and subject to penalties and interest after August 31st. If you own the real property, the assessed value of your business assets may be added to the value of the real property and you will pay the taxes in your November and March tax payments.

| ||||||||||||||||||||||||||||

|

New construction is appraised at fair market value as of the date of completion.

The land portion of the property is protected by Prop 13. The only change to this value would be a result of land improvements (septic, sewer, etc.) which would be added to the existing land value.

Yes and no. Under the rules of Prop 13 the Assessor reappraises new construction at fair market value when the improvements are complete. However, only the new construction is appraised. If you are simply adding a room, expanding an area, building a shed, etc., the existing assessed value of all other improvements will not be subject to reappraisal

No. The State Board of Equalization has offered seminars on the topic: What constitutes new construction? It really boils down to the value of the improvement, and its newness. Our office receives copies of permits from the various jurisdictions in the county on a regular basis. Many of these permits are purged up front (miscellaneous electric, special inspection, etc.) and are considered not reappraisable.

Our professional appraisal staff uses standard appraisal methods to value new construction. Of course, each appraisal has its own unique variable components of quality, utility, size and context

When construction is complete, the value of the new construction is added to the total assessed value of the property. The portion that is added will generate a supplemental bill which is calculated as 1% of assessed value. This supplemental amount is then prorated from the month following completion to the end of the fiscal year (June 30). For example, if I finish adding a $25,000 room to my house on September 15th, the assessment would be calculated as follows: ........ $25,000X.01 X .75 = $187.50 ....... No. Once the value is processed the additional tax will be split into two separate bills. These will be mailed out with due dates clearly indicated.

Not on a separate bill. Once the supplemental bills are paid the added value becomes a part of your total property value and is reflected in your yearly tax bill.

| ||||||||||||||||||||||||||||

|

The answers to the above questions can be found by using our property look up feature on our website or by calling the Public Service Unit of the Assessor's Office at 299-5500. We do searches by owner's name, site addresses and Assessor's Parcel Numbers Your escrow account should state that there has been some amount put toward the taxes for the "mother" parcel. Your first bill after purchase will be a supplemental, which should arrive about 10 months after purchase. If you have further questions contact the Tax Collector's Office at (408) 808-7900. The person and/or agency involved in writing up the deed should be contacted first. You may also contact the Assessor's Office and talk to the person who wrote the letter.

The tax amount (according to Prop 13) is 1% of assessed value. Many properties will also be subject to special levies. You will need to make reference to your specific parcel to find out what levies must be paid.

The California Revenue & Taxation Code is extremely complex. Since the passage of Prop 13 there have been numerous additions, corrections, and deletions to the law. There are exemptions and exclusions too numerous to mention. The best advice is to check with the local Assessor to see if you qualify for special processing of your transfer.

You should first call the Assessor's Office to discuss the assessment. You may talk directly to the appraiser and, often the matter is settled right at that level. If there is still a clear difference of opinion you must file an appeal within sixty days of the mailing date shown on the Notification of Supplemental Assessment. If you choose to appeal your assessment, you should still pay your tax installments in full by the appropriate deadlines; otherwise, you may incur penalties while the case is in appeals. If your appeal is granted, a refund will be issued to you. No. Unlike the annual tax bill, lending agencies do not receive a copy of the supplemental tax bill. When you receive a supplemental tax bill, you must contact your lender to determine who will pay the bill.

If you purchase and then sell your property within a short period of time, the supplemental tax bill you receive should cover only those months during which you owned the property. The new owner will receive a separate supplemental tax bill. Because of the large number of parcels and the frequency of property changing hands, there are often delays in placing new assessments on the roll. Be sure to check the dates used to prorate the bill to ensure that the period covered is the period during which you actually owned the property. Don't try to calculate the tax on your own. If you send an estimated amount, the Tax Collector will be forced to return your payment.

The supplemental tax bill provides the following information:

The bill may be paid in two installments and provides payment stubs for each installment. These show the amount due and the date that the amount must be paid to avoid penalties for late payment. You should check all of this information to see that it is correct. Any mistakes should be brought to the attention of the Assessor and Tax Collector immediately. REMEMBER: * Taxes on the increase in assessed property value due to ownership changes or completion of new construction are calculated as of the first day of the month following the date of ownership change or construction completion. ** Property is reassessed each January 1 for the upcoming fiscal year (July l-June 30). We recommend that you contact a Licensed Land Surveyor or Engineer to locate your property lines on the ground. We normally use what is shown on the latest recorded legal description of your property, or what occurred through various types of requests. You can contact the Public Service Counter of the Assessor's Office at (408) 299-5500 to get the document number containing the latest recorded legal description. PLEASE NOTE THAT ALL DATA CONTAINED ON OUR ASSESSOR'S MAPS ARE FOR ASSESSMENT PURPOSES ONLY. | ||||||||||||||||||||||||||||

|

Yes. Property can be exempt from taxes if it is used exclusively for religious, charitable, scientific, or hospital purposes and the owners file the necessary claim forms with the Assessor's Office

The exemption offered is only for the ad valorem tax collected on the bill. Special Assessment Districts and Direct Assessment charges (i.e. Sewer Service charges) are collected on the tax bill separately for other agencies. The Assessor cannot exempt these charges.

No. Only that portion of the property used for private purposes will not qualify for the exemption. The remaining portion of the property or facility will continue to be exempt from taxes.

No. Only those hospitals operated as nonprofit corporations qualify for exemptions. Private hospitals operated for profit do not qualify for property tax exemptions

Yes. Private schools can be exempt from property taxes if they are incorporated as nonprofit or religious organizations. Private schools that operate for profit do not qualify for an exemption.

| ||||||||||||||||||||||||||||

|

The Assessor's Office staff is not permitted to provide

legal advice about how you "should" change the title to your

property. We strongly recommend that you consult a

knowledgeable professional to advise you in these important

decisions. The Assessor's Office obtains ownership information

from documents, which are recorded in the Recorder's Office of

the Santa Clara County located at

110 W Tasman Dr 1st floor, San Jose, CA 95134 . If you need general information on how to record a document you can call 408-299-5688. Any reputable office supply stores, attorneys, paralegal, title companies, etc

The person and/or agency who drafted the deed should be contacted first. Give them a copy of the letter to assist them in re-writing and re-recording the deed. You may also contact the Assessor's Office at the number shown on the letter to receive more information from the person who wrote the letter.

| ||||||||||||||||||||||||||||

|

Yes. Even if you don't own the real property where your business is located, you must still file the statement reporting business personal property (equipment, supplies, etc.) that is being used in your business. You must also complete any related schedules that apply to your particular business. If improvements and/or fixtures were added during the last 12 months they must be reported on Schedule B. Please see official instructions for the 571-L to determine the classifications between "Structure" (Schedule B, Column l) and "Fixture" (Schedule B, Column 2).

If you are using any 'personal' equipment in your business, then yes, it must be reported. For example, persons working out of their homes must report personal desks, computers, calculators and etc., if those items are used in their business. Other examples include: Example 1: Someone operating an auto repair shop is using their own 'personal' tools in the business. In this case, such tools become assessable as business personal property and must be reported. Example 2: A home business or auto repair shop goes out of business prior to January 1. In this case, any equipment previously used in the business that could revert back to 'personal' use is no longer taxable. Such items become nontaxable because they can revert to being 'Household Furnishings or Personal Effects,' which are exempt. Example 3: A grocery store goes out of business prior to January 1st but equipment such as freezer boxes and store shelving remains in the building or in storage on that date. In this case, such items would still be taxable and must be reported even though the business was closed on the Lien Date. That is because in this instance the equipment could not revert to or be used as 'Household Furnishings or Personal Effects'. Example 4: If you take "personal" equipment (i.e. desk, chair, refrigerator etc.) from your home to a business location that equipment is reportable and taxable. Equipment gifted to you for use in your business is taxable and must be reported on the property statement. If you don't know the equipment cost and/or year of acquisition, provide a good description including make and model and the general condition of each piece of equipment

Yes. The statement must show all taxable property owned, claimed, possessed, controlled or managed by the person filing the form. If your friend is not reporting the equipment and you are in possession of it then you must report it. If you don't know the equipment cost and/or year of acquisition, provide a good description including make and model and the general condition of each piece of equipment. On the other hand, if your friend is reporting the equipment or you are not responsible for the tax, then you should declare the equipment in Part III of the statement ("Equipment Belonging to Others"). Where equipment is declared in Part III, the Assessor will also send a statement to the person reported as the equipment's actual owner.

Yes. In this case, you need to write a remark about that circumstance on the statement, or on an attachment. Also fill out Part III ("Equipment Belonging To Others") of the form, and then sign and return it to the Assessor's Office. If you own any small equipment, such as a printer, copier, supplies, etc., which you are using in the business you need to report these costs under Part II of the statement.

Yes. You are required to report this information in Part III of the statement so that the Assessor can properly locate and assess the actual owner for the equipment. However, if you own any small equipment, such as a printer, copier, supplies, etc., which you are using in the business you need to report these costs under Part II of the statement.

Yes. Any equipment used for a home business is considered to be business personal property and must be reported on the statement.

Yes. Note these facts on the BPS, or on an attachment, and include the name and address of the business that actually owns the equipment. Then sign the statement and return it. You also need to report any equipment or supplies you might own in Part II of the statement.

Yes. Please note those facts on the statement, or an attachment, providing an explanation for why you are maintaining a business telephone and are not in business or have no equipment. Return the signed statement to the Assessor's Office

To Be Answered.

Yes. Please note those facts on the statement, or an attachment, and return the signed statement to the Assessor's Office. Please also include the name and mailing address of the company you work for among your notes. The Assessor needs to know these facts in order to prevent an improper assessment from being issued to you.

| ||||||||||||||||||||||||||||

|

Effective for transfers on or after March 27, 1996, certain transfers of real property between Grandparents and Grandchildren may be exempt from reassessment. To qualify, all of the parents (the children of the Grandparents) of the child must be deceased. Exceptions to the general rule: where the surviving parent of the child is not in the same bloodline as the Grandparent, was divorced and remarried at the time change of ownership occurred, the parent doesn't qualify as the child of the Grandparent and the exemption would be available. Only the Grandparents may be transferors and Grandchildren recipients of the property. Special claim forms for the Grandparent/Grandchild exemption are available by clicking here or by calling (408) 299-5540

| ||||||||||||||||||||||||||||

|

Prop 8 was one of the early amendments to Proposition 13. Prop 13, as you may know, changed California's method of property taxation from a market appraisal system to an event driven system. Due to the pressures of ever increasing property values the taxpayers revolted. They amended the constitution to state that instead of constantly raising our assessments every 3 or 4 years, only reassessments at market value can occur when there is a change of ownership or new construction. Until one of these events occurs assessments may only increase by the consumer price index and this can be no more than 2%. As you can see, the impetus and the context of Prop 13 was a rising real estate market. It didn't take long for the question to arise: If my values are "frozen", what happens when the market goes down? I'll be paying taxes on an assessment that is above the market....!' And so.......Prop 8 was born.

Very simply, it added a few words to the California Revenue and Taxation Code which make reference to adjusting base year values to take "into account reductions in value due to damage, destruction, depreciation, obsolescence, removal of property, or other factors causing a decline in value". R & T Code Section 51(a) (2)

Yes. The Assessor initiated reductions on single family residences in Santa Clara County beginning in 1991. At that time it was clear that the real estate market was experiencing more than a temporary slump. At the height of the slump, almost 100,000 properties received temporary relief. In 2001/2002 fewer than 1,000 properties received Prop 8 relief, which parallels the markets strong rebound through the assessment year 2001. Following the declining market in 2008, the Assessor has reduced the assessed values on over 90,000 homes

The Assessor has a one page form which may be submitted. Any supporting data (appraisals, comparables, multiple listings, etc.) will be helpful in expediting your reduction if it is warranted.

No. We have a very knowledgeable and experienced staff. Our appraisers are professionals who will be more than willing to discuss your assessment with you.

Following receipt of the Assessment Notification in late June, requests should be filed for review no later than August 1 of the current assessment year.

A reduction to the factored base year value under the auspices of Prop 8 is not permanent. The Assessor is required to track every reduction and review the assessed value annually until the factored base year value is restored.

A simple one page form can be completed on-line.(See below)

If a reduction in assessed value has occurred, the Assessor will proactively review your assessment every year until the value is restored to its appropriately factored base year value. If you believe the value has declined again, then you may submit another form to request a further review of your assessment.

| ||||||||||||||||||||||||||||

|

The information is useful for the appraiser, who will determine what the new base year value of your property is, due to the change in ownership.

Is this information confidential, because I don't feel comfortable filling out the loan information?

Yes. This information is considered confidential and is not open to public inspection.

We do not penalize you for not completing the letter. However, filling out the letter may be helpful, because it allows you to give the information to the appraiser

Please explain your situation in the remarks area or attach a letter, and the information will be sent to the appraiser.

| ||||||||||||||||||||||||||||

|

Anyone who pays property tax on property that has been physically damaged or destroyed without his or her fault.

The extent to which restricted access is eligible for tax relief is currently being determined by the state courts.

There must be a loss of at least $10,000 full cash value.

Section 170 of California's Revenue and Taxation Code says that the "application for reassessment may be filed...within 12 months of the misfortune or calamity...by delivering to the assessor a written application requesting reassessment showing the condition and value, if any, of the property immediately after the physical damage or destruction, and the dollar amount of the damage." (see link for application form on forms download page)

There is a formula which is used so that the appropriate amount of assessed value (the value which determines the amount of your property tax payment) is removed. A representative from the Assessor's Office will determine the market value (the current full cash value) of the damage and then calculate how much this represents in assessed value on the subject property. The reduction in assessed value will generate a "negative supplemental assessment". The reduction is prorated from the date of the event.

When the property is restored the assessed value is also restored. This adjustment will generate a "positive supplemental assessment" prorated from the month after restoration

Yes. The Prop 13 base is subject to a Consumer Price Index every year and so the restored value will reflect this increase. In addition, if any new square footage is added at the time of restoration this will be assessed as new construction and the value will be added to the assessment at the time of completion

| ||||||||||||||||||||||||||||

|

You have a few options based on the proximity to tax deadlines. a. If it is close to tax deadlines, send it to the new property owner. The new property owner's address will be on the tax bill. If not call Tax Roll Control at (408) 808-7979. b. Return the tax bill to Tax Roll Control. Call (408) 808-7979 for mailing address and further instructions. The first option (a) is recommended if at all possible. | ||||||||||||||||||||||||||||

|

Yes. The list is referred to as the "inspection of the 2 year sales list" and is open to inspection by any person for a nominal fee which is valid for one year, plus any additional photocopy charges. We provide the information on microfiche, of the transfers that occurred within the preceding two-year period and they are updated quarterly. The microfiche is in Assessor's parcel number order, and contains the following information: transferee, address of the sold property, date of transfer, document number, transferor, date of recording, indicated sales price, and land use code. Please contact 299-5500, if you have any questions. For a complete list of fees see our fee schedule or for more general information on, and forms for purchasing data from the Assessor's Office please visit assessor web site.

| ||||||||||||||||||||||||||||

|

In simple terms, a supplemental tax bill reflects any increase or decrease in property tax generated by a supplemental event, effective immediately after the event takes place. A supplemental assessment becomes effective on the first day of the month following the month in which a supplemental event takes place. For example, if a supplemental event occurs on September 5, any increase or decrease in taxes resulting from that event becomes effective October 1. If your purchase is during the "two bill period" from January 1 through May 31, you will receive two Supplemental tax bills. If bills are mailed during July through October, the two installments are delinquent on the same dates as the regular bills, December 10 and April 10. If the Supplemental bills are mailed during November through June, the first installment is delinquent by the end of the month following the month the bill is mailed, and the second installment is due four months later.

The "Supplemental Roll" is the accumulation of supplemental assessments made by the Assessor. The property is first reassessed by staff of the Assessor's office. The reassessments are then sent to the County Auditor for enrollment. After that, they go to the Tax Collector for the creation and mailing of supplemental bills. Due to the large volume of reassessments, staffing considerations and other factors, the whole process may take several weeks to several months between the supplemental event and the mailing of tax bills. Where new construction is completed, or property changes ownership, the Assessor determines the current fair market value of the portion of the property which was newly constructed or changed ownership. The Assessor then subtracts the property's prior assessed value from its new assessed value. The difference between the two (increase or decrease) is the net supplemental value which will be assessed and enrolled as a supplemental assessment. Once the new assessed value of your property has been determined, and the paperwork is completed, a "Notice of Supplemental Assessment" is mailed which shows the former roll value, the new assessed value, and the net supplemental assessed value. If the net supplemental assessment is a positive number, there will be an increase in taxes and a supplemental tax bill will be generated. If the result is a negative number, that is the value has declined, a supplemental refund will be generated and you will receive a tax refund check. A supplemental reduction in value will not reduce (nor can it be used as a credit toward) the amount still due on the existing regular annual tax bill. The amount of tax originally billed must be paid even though the assessed value of the property was reduced by the supplemental assessment Yes. The supplemental tax bill is sent in addition to the annual tax bill and both must be paid as specified on the bill

Most lenders will not pay the Supplemental property tax bill for you from their escrow account, as it is calculated only to pay regular taxes. As a result, supplemental bills are sent directly to the property owner. When you receive a supplemental tax bill, you should either pay the bill, or contact your lender to discuss who should pay the bill The supplemental tax bill provides the following information:

If you purchase and then resell property within a short period of time and the Assessor has not already issued a supplemental assessment for the date you first acquired the property, any supplemental tax bills will be prorated between you and the new owner. In that particular case, you should receive a supplemental tax bill that reflects only the actual time period which you owned the property. The new owner should receive a separate supplemental tax bill that reflects their period of ownership from the date they acquired the property from you until the end of the fiscal year. However, if a supplemental assessment for the transfer in which you first acquired the property is issued before the Assessor is aware of a subsequent sale of the property, the county cannot prorate the bill between you and the new owner. Proration of any such supplemental bill becomes a private matter to be resolved between buyer and seller Supplemental refunds or bills are calculated based on the number of months remaining in the current fiscal year after the month in which a property transfers or after the date new construction was completed. For example, if a supplemental event raises the annual tax by $200 and there were six months left in the current fiscal year when the event occurred, the supplemental tax bill would be 50% of the $200, which is $100. Because a change in the tax due to a supplemental event becomes effective on the first day of the month following the month in which the event took place, monthly proration factors are used to calculate the taxes owed. Taxes supplemental to the current roll are computed by first multiplying the Net Supplemental Assessment by the tax rate, and then multiplying that amount by a monthly proration factor. The proration factors are:

* A supplemental event that occurs in June rolls over to July 1, the first day of the new fiscal year. As a result, there is no supplemental assessment to the current roll; however, there is a supplemental assessment to the new main roll (the annual tax roll created on the January 1 Lien Date), that covers the full 12 months of the coming fiscal year, Therefore, a single supplemental bill or refund is issued In some cases a taxpayer might receive two supplemental tax bills, depending on the date the reassessment occurred. If a supplemental event occurs on or between June 1 and December 31, there will be only one supplemental Bill (or refund). That bill is for the current fiscal year during which the supplemental event took place. If a supplemental event occurs on or between January 1 and May 31, it will generate two bills (or refunds). The first bill is for the current fiscal year during which the supplemental event took place. The second bill is for the upcoming fiscal year. The second bill is generated because the main roll for the upcoming fiscal year, with its January 1 Lien Date, does not reflect the change in value generated by the January 1 through May 31 event. You can also receive multiple supplemental bills in situations where a series of supplemental events take place over time. For example, you complete a pool in March; this generates two supplemental bills. Then in April, a garage is added; that generates two more supplemental bills. In any given tax year, no matter how many supplemental bills you receive for that year (in addition to the main roll bill), the property tax portion of all those bills will not add up to more than it would have been if the full assessment had been reflected in the main roll bill to begin with The date on which supplemental tax bills become delinquent depends on when they are mailed by the Tax Collector. As outlined below, if the bill is mailed between July 1 and October 30, the taxes become delinquent at 5:00 P.M. on December 10 for the first installment, and 5:00 P.M. on April 10 for the second installment (the same schedule as for annual tax bill). Bill mailed between July 1 and October 30 1st installment delinquent after - December 10 2nd installment delinquent after - April 10 If the bill is mailed between November 1 and June 30, the delinquency dates - which are printed on the bill - are determined as follows:The first installment is delinquent at 5:00 P.M. on the last day of the month following the month the bill was mailed; the second installment is delinquent at 5:00 P.M. on the last day of the fourth month after the first installment delinquency date (see below). Bill mailed between November 1 and June 30 1st installment delinquent Last day of the month following the month bill was mailed 2nd installment delinquent Last day of the 4th month after the 1st installment became delinquent No. The full amount of each installment must be paid in full. If not, the partial payment will be returned to you. Or, the payment may be placed in the Tax Collector's Trust account; in which case you will be notified of the additional amount required to pay the installment in full. If you fail to respond by the deadline contained in that notice, your original partial payment will be returned to you. Penalties and fees may be added to the bill.

Most supplemental bills are mailed within nine (9) months after a change in ownership or new construction. You should receive a Notification of Supplemental Assessment approximately sixty (60) days before the bill is mailed. To avoid penalties, you should check the status of your property taxes and/or request a duplicate bill by contacting our office. Do not wait until it is too late as penalties will be added. Our contact information is located at www.scctax.org. Admittedly complicated and confusing, Supplemental Assessments were created by Senate Bill 813 in 1983 to close what was perceived as loopholes and inequities in Proposition 13. Prior to the creation of supplemental assessments, changes in assessed value due to a change in ownership or completion of new construction would not result in higher taxes until the tax year (July 1 to June 30) following the lien date when the new values were placed on the assessment roll. In some instances, taxes on the new assessments would not be collected for up to 21 months. This resulted in serious differences in tax treatment for transactions that may have only been separated by one day. Supplemental assessments are designed to identify changes in assessed value (either increases or decreases,) that occur during the fiscal year such as changes in ownership and new construction. They are in addition (supplemental) to the traditional annual assessment and property tax bill. A tax bill is issued only on the added value, and is prorated for the remaining portion of the fiscal year. For the next fiscal year, the entire new assessed value of the real property is added to the regular assessment roll. The increase in value is taxed from the first of the month following the date of completion of new construction or the change in ownership. | ||||||||||||||||||||||||||||

|

The Assessor’s Office is changing the way possessory interest in government owned property will be assessed for the 2014 Regular Roll. In the past each possessory interest was enrolled on the Unsecured Property roll using an account number. This type of assessment generated an ad valorem tax bill with a single payment stub due in the summer of the fiscal year. Starting in 2014 each possessory interest will be assessed on the Secured Property roll using an Assessor Parcel Number (APN). This type of assessment will generate a tax bill with 2 payment stubs, due in November and March of the fiscal year, just like every other real property secured tax bill. A major distinction for the possessory interest secured tax bill is it will not be subject to per parcel taxes, the bill will continue to reflect an ad valorem tax based on the assessed value. This change will not alter the method for determining the assessment or the tax due. Another benefit to this change is the creation of Supplemental Assessments. Since possessory interests are by definition interests in Real Property they are subject to the supplemental assessment provisions of the Revenue and Taxation Code. These provisions equalize the assessment of property by enrolling the new assessment as of the date of the underlying transaction, most likely a lease in the case of a possessory interest. The Notice of Supplemental Assessment alerts the taxpayer of the assessment prior to the mailing of the supplemental tax bill and will contain information regarding the filing of assessment appeals. This change is being made pursuant to requests by the Board of Equalization in the last few Santa Clara County Assessment Practices Surveys. If you have any questions regarding these changes please contact the Possessory Interest email box at [email protected], or the Real Property Division main number at (408) 299-5300. A taxable Possessory Interest exists whenever there is a private, beneficial use of publicly-owned, non-taxable real property. Such Interests are typically found where private individuals, companies or corporations lease, rent, or use federal, state or local government owned facilities and/or land for their own beneficial use. Examples of Possessory Interests include such things as: