How Proposition 13 Works

Proposition 13 provides three very important functions in property tax assessments in California. Under Prop 13, all real property has established base year values, a restricted rate of increase on assessments of no greater than 2% each year, and a limit on property taxes to 1% of the assessed value (plus additional voter-approved taxes).

Understanding Base Year Values

Once Proposition 13 passed, property assessments for the 1978-79 fiscal year were required to be “rolled back” to 1975-76 values, establishing the first base year values in California. Properties that have not sold or undergone new construction since February 1975 are said to have a 1975 base year value.

When a change in ownership occurs, whether full or partial, real property is re-assessed at its current market value as of the date of transfer. This establishes a new base year value for both the property’s land and improvements. If only a partial change in ownership occurs, the original base year value is retained for the part of ownership that does not change, and a new base year value is created for only the part of ownership that has changed.

When new construction occurs, it is re-assessed at current market value as of the date of completion. This establishes a new base year value for the property’s newly constructed improvements only. If construction is deemed new or substantially equivalent to new, the base year value for improvements is established entirely on the date of construction completion. If construction is deemed an addition, the original base year value for improvements remains and a new base year value on the date of construction completion is added. The base year for land is unchanged by new construction.

Business Personal Property, boats, airplanes and certain restricted properties are subject to annual reappraisal and assessment.

Understanding Rate of Increase Limits

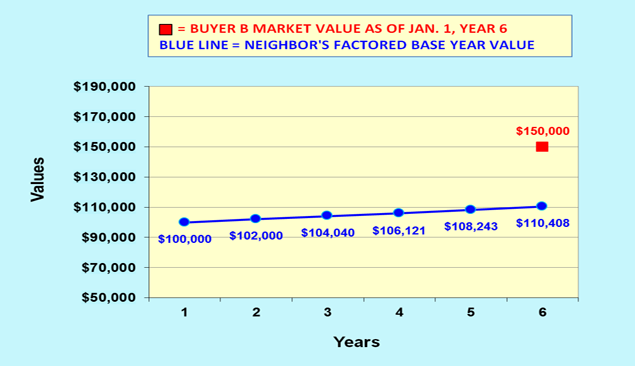

The assessed value of a property is limited to an increase no greater than 2% each year unless a change in ownership or new construction occurs. The 2% increase is originally applied to the base year value, and is thus referred to as the factored base year value. In the case of real property, the factored base year value is the upper limit for property tax purposes. The maximum 2% increase per year continues to be applied until a change in ownership or new construction occurs, even if a temporarily reduced value has been put on the roll under Proposition 8.

Understanding Property Tax Limits

Under Proposition 13, property taxes are limited to one percent of the assessed value. Additional property taxes may be approved for schools or local projects, which can vary amongst communities and bring the tax rate higher than one percent. These additional property taxes change annually and are determined by voters in each tax rate area.

Why Am I Paying More Taxes Than My Neighbor?

Historically, market values of real property have increased at a significantly greater rate than factored base year values. Because of this, a widening disparity between market values and assessed values has emerged in Santa Clara County.

A property purchased in 1980 with changes in ownership or new construction will usually have a much lower assessed value than a property with similar characteristics purchased in 2011.

For example,Buyer A neighbor bought a property in Year 1 for $100,000 (base year value). By Year 6, that property would have a factored base year value of $110, 408. Buyer B bought a similar property in Year 6 for. $150,000. The market value of both properties is $150,000, but the taxable assessed value of Buyer A’s property purchased in Year 1 is $110,408 while that of Buyer B’s property purchased in Year 6 is $150,000. The factored base year value of the property purchased in Year 1 is not indicative of the market value of the similar property purchased in Year 6.